Break-Even Analysis Case Study

You and several of your colleague business partners have decided to establish an outpatient fertility clinic in your service area. All of you are very familiar with this patient population base, have completed an extensive market analysis that demonstrated a great need for the service, and are comfortable with setting up a business and the costs associated with this special group of patients.

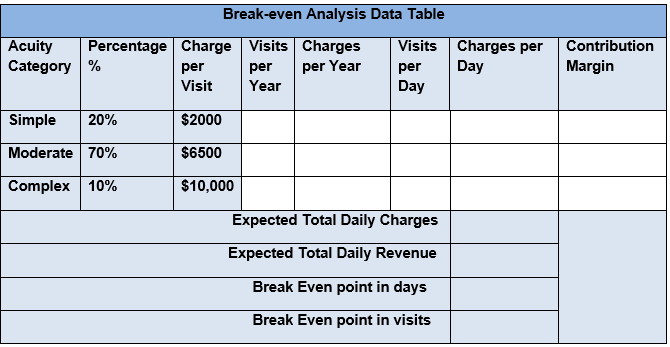

As part of the business plan, you and your partners will need to convince stakeholders that this new service endeavor will be viable. They will want to know how many patients visits annually will need to occur and how long it will take for the service to be at least cost neutral or profitable. To provide them with this information you will perform a break-even analysis. Use the following data, conduct the analysis accounting for the contribution margin of each patient acuity category.

- Fixed Costs: $9,788,000 (start-costs, specialty physicians, anesthesiologists, APNs, staff

nurses and other staff salaries, specialty equipment, other miscellaneous)

- Variable costs: $500/patient visit (specialty equipment, oxygen supplies, other

miscellaneous)

- Clinic days: Monday-Saturday- 305 days/year

- Projected patient visits per year: 7480

- Patient charges by patient acuity category:

- Simple (20%)————$2000/visit

- Moderate (70%)——–$6500/visit

- Complex (10%)———$10,000/visit

2. Perform the calculations needed for the break-even analysis. Show your work, formulas used, and reference the formula. When calculating the patient visits per day, round to the nearest whole. After you’ve completed the calculations, record your results in the appropriate place in the table.

3. How many patient visits are expected per day?

4. What is the contribution margin of each category of patient?

5. Based on the data and your calculations, what is the expected daily revenue?

6. How long (in days, months, or years) will it be before the return on investment begins?

7. How many patient visits will be required to reach the break-even point?

8. Discuss your analysis. Is the project viable and profitable service? Does the analysis support moving forward with the business? Cite specific data from your analysis to support your interpretation.

You may want to check (Solved)NR533 Week 5: Cost-Benefit Analysis.

Solution

- Describe your approach to this case study. In addition to the numbers given, what do you need to know before you can calculate the break-even analysis?

In this case study, I will start by identifying the variable costs and fixed costs which will later be combined into a single total cost line. The break-even point happens when the total cost line intersects with the firm’s revenue line. Besides, I will emphasize the firm’s profit contribution by observing the total visits that will be performed. As argued by Sintha (2020), break-even analysis involves a financial calculation that is critical in determining the total number of services and products needed to sell in order for the business to identify the costs incurred. Therefore, before calculating the break-even analysis, it is prudent to identify the average sales per unit price. Also, it is essential to equate the total expenses with the total revenues in order to determine the project profitability.

- Perform the calculations needed for the break-even analysis. Show your work, and formulas used, and reference the formula. When calculating the patient visits per day, round to the nearest whole. After you’ve completed the calculations, record your results in the appropriate place in the table.

Break-even = Fixed costs/revenue per patient – variable costs per patient (Leger & Dunham-Taylor, 2017).

The visits per year = Total visits per year x percentage (The one offered in the category).

Therefore;

Simple = 7480 x 20% = 1496

Moderate = 7480 x 70% = 5236

Complex = 7480 x 10% = 748

Total charges per year = Total visits x charge per visit

Therefore;

Simple = $2000 (charge per visit) x 1496 (Total visits) = $2,992,000….Kindly click the purchase icon to purchase the full solution at $10